Small Business Tax Organizer

A simple way to organize your income and expenses for tax time…without bookkeeping software.

This organizer is for small business owners who have put off dealing with their income and expenses, not because they don’t care, but because it’s mentally exhausting to revisit decisions that are already made.

The money has been spent. The year has moved on. And figuring out what goes where often feels harder than it should.

I built this for the moment when “I’ll deal with it later” becomes “I need to deal with it now,” without making that moment heavier than it already is.

This organizer provides a simple, structured space to store things once, so you don’t have to keep reorganizing them.

Download the Small Business Tax Organizer

This is a simple Excel workbook designed to help you organize your income, expenses, and mileage in a way that aligns with how small business taxes are reported in the U.S.

It’s not bookkeeping software.

It’s not a replacement for a tax professional.

It’s a calm, structured place to put things once, so you can move forward without having to rethink everything.

$29 • Instant download • Excel format

Payment & Delivery

After purchase, you’ll receive immediate access to download the Small Business Tax Organizer. This is a digital product delivered instantly. No physical items will be shipped.

Important Note

This organizer is designed to help you organize information for tax preparation. It does not replace professional tax advice.

FAQs

Frequently Asked Questions

Questions and answers to help you understand what this tool is and what it isn’t.

Is this bookkeeping software?

No. This is not bookkeeping software and it’s not meant to replace tools like QuickBooks or a bookkeeper.

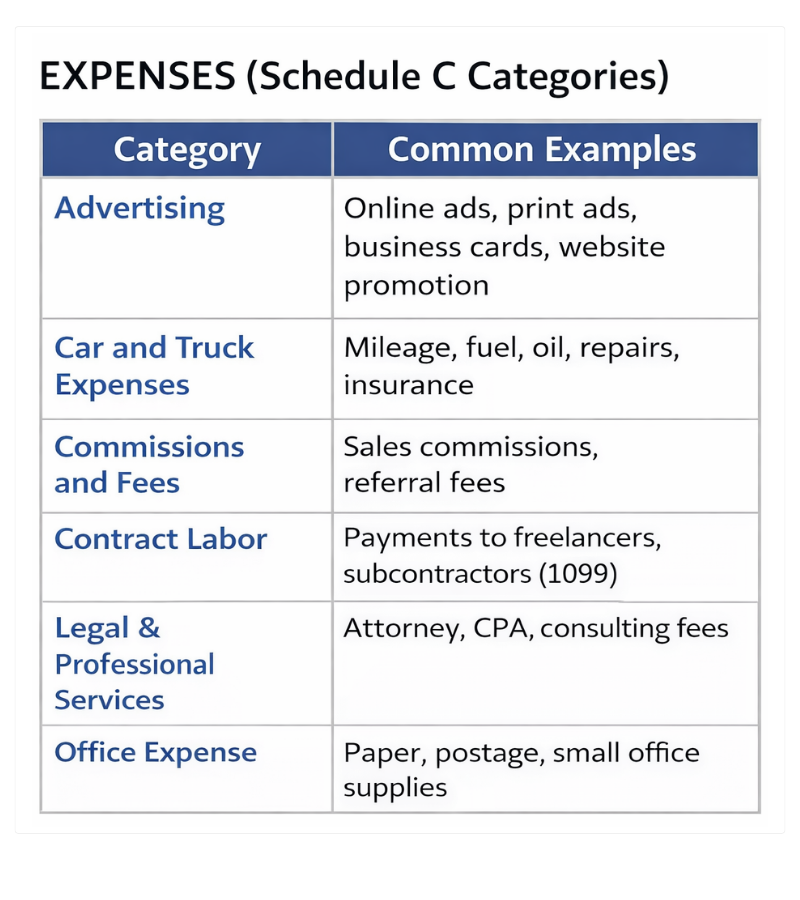

This is a simple Excel workbook designed to help you organize your income, expenses, and mileage in a way that aligns with the way that income and expenses are reported on the IRS Schedule C.

Do I still need a tax professional?

Possibly, yes.

This organizer helps you gather and organize your information. It does not prepare or file your tax return and it does not provide tax advice. Many people use it alongside a tax professional or hand it off at tax time.

What if I'm behind or doing multiple years at once?

That’s okay.

You can use this organizer to work through prior years one at a time. Many people use it specifically to catch up before tax time or before meeting with a tax professional.

Once you download it, you can “Save As” to create a file for each tax year you need to complete.

Do I need to track things daily or monthly?

Not necessarily.

While it is a good idea to track your income and expenses regularly, this workbook is designed to work whether you enter information daily, weekly, monthly, quarterly, or all at once. You can gather receipts and bank statements and enter everything when you’re ready.

Does this work if I use cash accounting?

Yes.

Most small business owners who file a Schedule C use the cash method, and this organizer is designed with that in mind.

Can I use this if I plan to file my own taxes?

Yes.

If you plan to prepare your own return, this organizer helps ensure your income and expenses are categorized in a way that matches how they’ll appear on your tax forms.

What software do I need?

You’ll need Microsoft Excel or a compatible spreadsheet program.

Some formatting and protections may not carry over perfectly in Google Sheets, but the organizer will still help you get everything in one place.

Is this a one-time purchase?

Yes.

This is a one-time purchase. There are no subscriptions and no ongoing fees. You can use this in past, current, and future years (until the IRS changes the Schedule C).

Can I get a refund?

Because this is a digital download, refunds aren’t typically offered once the file has been accessed. If you have trouble downloading the organizer or if something doesn’t work as expected, please reach out, and I’ll help.

If you have any questions before purchasing, feel free to contact me first.